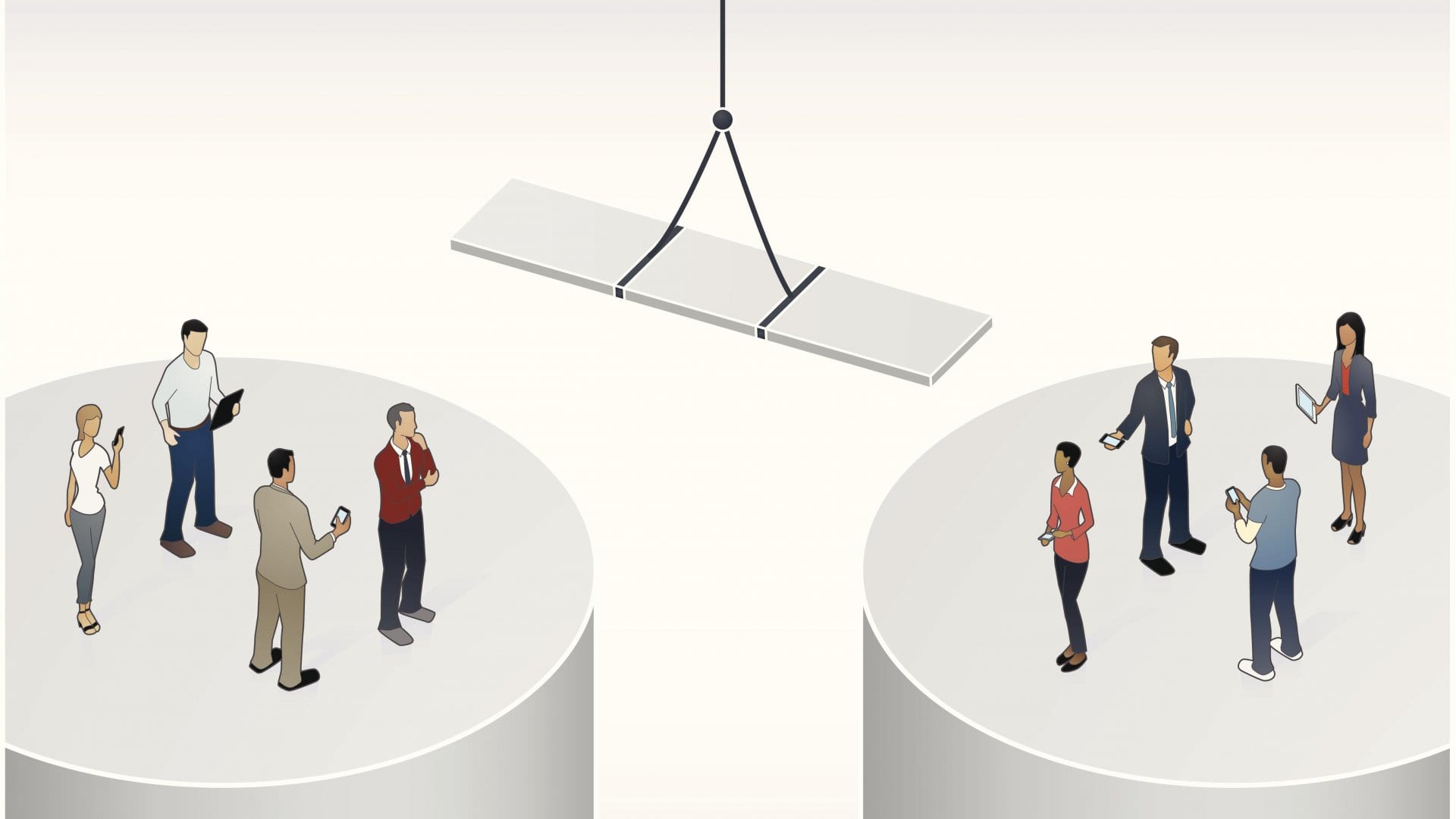

The truth is that two companies are never equal.

How to navigate business acquisition challenges.

I’ve written before about the art and science behind making company acquisitions. Usually, one company, the acquirer, pays cash to buy another company, the acquiree. While there can be wrinkles in how that payment is structured–there could be earn-outs for the owner and debt or even stock in the new company could be part of the deal–there is definitely a transfer of control of the acquiree’s company.

But there’s another model of how to structure acquisitions that are becoming popular: the cashless merger. In this approach, there is no cash sent either way. Two equal companies, Company A and Company B, agree to merge to create a new entity–Company C–or perhaps continue as Company A with different ownership.

In a perfect scenario, the ownership of Company C is split evenly between Company A and Company B: Each side owns 50 percent of the new entity.

This sounds wonderful, right? By creating Company C, the two companies have doubled their share of the market at no cost to either side. It makes you wonder why everyone doesn’t do acquisitions this way.

Turns out there are a few common sticking points that explain why everyone can’t pull this off. It boils down to the fact that companies are never equal. In one way or another, there are differences between companies that present real challenges in executing a cashless merger. The key is to head off the most common issues before they muck up the deal.

It’s been my experience, working on dozens of deals, that there are four common sticking points to successfully executing a cashless merger:

1. Relative Valuation

Companies are never truly equal when it comes to financial metrics like revenue or profit. So how do you decide who should have a majority interest in the new venture if these things are unequal? If one company is larger and thus has greater revenues, should that trump the interests of the small company that is more profitable? Most companies never get past solving this hurdle.

The only way I’ve seen this potential deadlock broken is by having both companies agree on the same method of relative valuation–like a multiple of earnings or sales–and use that as the basis for a conversation. If you can’t agree on this, you likely can’t make a deal.

2. Who’s in Charge?

When you put together two companies of similar size, you have two of everything–especially executives. While the new company might need an expanded leadership team, you certainly won’t need two sets of execs. That means it’s always a process to decide who stays–and who goes.

This is yet another hurdle that trips many deals up. You really need the owners to have a frank and honest conversation about how to choose the people best for the company–and not just to focus on keeping “their people” in place. That can be especially tricky when it comes to the role of the CEO. If one owner is giving up this role, she might want to fight harder to keep her people in place. But the key to making this dynamic work is to focus on enlightened self-interest and doing what’s best for the good of the company–which will also be best for the owners and, longer-term, for the employees.

3. Title Problems

Another hurdle that’s related to leadership is the issue of job titles and who gets them. Some companies are quite generous in handing out lofty titles. Everyone can be an executive senior VP. Meanwhile, other companies can have people doing those exact same jobs, for the same pay, only they have the lesser title of director.

How do you sort that out inside the new company? It’s important to do it early or you can find that you’ve created a new power dynamic inside the business. A real-life example comes from when the two former Baby Bell telephone companies, Nynex and Bell Atlantic, merged to become Verizon. It turns out that Nynex was very generous in handing out big titles compared to Bell Atlantic. This fundamental difference was not resolved in the merger process and, as a result, Nynex culture carries far more power in Verizon to this day.

4. Benefit System

A fourth element that can become a barrier in a cashless merger is differences in benefits for the two companies. When it comes to policies related to paid time off, 401(k) matches, or health insurance plans, every company does it slightly differently. But the cost per employee is usually close. The challenge in the merger, though, is that if you choose the best benefits from each company and apply them to the new one, you could easily see your benefit spend per employee go through the roof.

You can solve this challenge by applying a cafeteria model where you set a budget for each employee for benefit spending and then let them choose which options work best for them. A young single employee might want more PTO, for instance, while the head of a family might want a better health insurance plan. A more senior employee might opt for a higher 401(k) match. The point is: Set the number and let them choose.

So, if you see an opportunity to create a cashless merger between equals, remember the advice that there is no such thing as equals when it comes to a merger. Be aware of the common hurdles that can foil such deals and get ahead of them if you want to maximize your chances of success in pulling off a successful deal.